Welcome, AI & Semiconductor Investors.

Nvidia faces a new regulatory spotlight as China questions its Mellanox acquisition, potentially reshaping how the AI chip giant navigates global market pressures.

We also cover Apple’s modem ambitions and Synopsys’ earnings stumble. Let's dig in…

What The Chip Happened?

🎯 Nvidia’s Mellanox Moment: Under the Regulatory Lens

📱 Apple’s In-House Modem Gambit: Challenging Qualcomm’s Hold

😬 Synopsys Stumbles Post-Earnings: A Half-Year Hurdle?

Read time: 7 minutes

NVIDIA (NASDAQ: NVDA)

🎯 Nvidia’s Mellanox Moment: Under the Regulatory Lens

What The Chip: China’s State Administration for Market Regulation has opened an investigation into Nvidia’s conduct following its 2020 acquisition of Mellanox Technologies. Reports from Bloomberg and state media suggest regulators are looking into whether Nvidia’s handling of the Israeli networking firm’s technology and relationships violates anti-monopoly conditions set by Beijing.

Details:

🇨🇳 Regulatory Spotlight: Chinese officials are probing whether Nvidia complied with a key deal condition that Mellanox share product information with Chinese rivals within 90 days—something Nvidia agreed to as part of the $7 billion acquisition approval.

🌐 Crossfire of Superpowers: Nvidia’s leading position in AI and semiconductor technology places it at the intersection of US export restrictions and Chinese market scrutiny. Washington’s ban on Nvidia’s most advanced chips to China, designed to safeguard US tech dominance, has drawn criticism from Beijing.

📉 Market Reaction: Nvidia shares slipped by about 2% in early trading following the announcement. This drop indicates investor anxiety about how regulatory overhangs in a key growth region might impact Nvidia’s future sales and strategic moves.

🗣 Management Perspective: While Nvidia hasn’t commented directly on the probe, executives have previously emphasized a commitment to “compliance with local regulations” and ensuring that “all customers and partners have the support needed to integrate our technologies.”

🇺🇸 Other Probes: It’s not just China—Bloomberg reported that the US Justice Department also looked into Nvidia’s practices, with sources alleging the company’s moves may have made it harder for customers to switch away from its AI chips.

👀 Bearish Watchpoint: Ongoing regulatory inquiries can bring uncertainty, potential fines, or forced changes in business practices. Longer-term, this may impact Nvidia’s competitive edge if it can’t freely distribute cutting-edge products.

🔌 Strategic Edge: Despite these challenges, Nvidia’s push to develop export-compliant AI chips for Chinese customers signals a strategic willingness to adapt—potentially preserving an important revenue stream in a highly competitive global market.

Why AI/Semiconductor Investors Should Care: The scrutiny of Nvidia underscores the complexities of operating at the leading edge of AI hardware amid geopolitical frictions. Investors should watch for any regulatory conditions that might slow product rollouts or dent Nvidia’s market share. Ultimately, how Nvidia navigates global watchdogs could influence its long-term pricing power, innovation pace, and overall valuation trajectory.

Moore Semiconductor Investing

📗 Unlock Q3 Semiconductor Earnings --- 50% OFF

What The Chip: Get a front-row seat to the financials shaping the semiconductor industry. This continuously updated e-book by Jose Najarro distills the latest quarterly insights—from wafer production trends to AI chip breakthroughs—into a single comprehensive resource.

Details:

🔵 Dynamic Updates: Start with giants like TSMC and ASML, then expand to 30+ companies as their Q3 2024 earnings roll in. Already covering over 30 companies.

🔵 Huge Value for Half the Price: For a limited time, the e-book is discounted from $49.07 USD to $24.54 USD, offering a robust market guide at a significant value.

🔵 Expert Analysis: Curated by Jose Najarro (Master’s in Electrical Engineering, contributor at The Motley Fool), delivering reliable, accessible breakdowns.

🔵 Key Metrics & Trends: Follow critical financial indicators, market shifts, and executive comments shaping the sector’s trajectory.

🔵 Broad Coverage: From traditional chipmakers to cutting-edge AI semiconductor players, get the full picture as it emerges.

Why AI/Semiconductor Investors Should Care: This evolving earnings handbook gives you a strategic edge. Understanding quarterly earnings data is crucial for gauging industry health, discovering new growth leaders, and aligning your investment approach with emerging technological waves.

Disclaimer: For educational and informational purposes only. Not financial advice. Consult with a qualified professional before making any investment decisions.

Apple (AAPL)

📱Apple’s In-House Modem Gambit: Challenging Qualcomm’s Hold

What The Chip: Apple is reportedly set to launch its own modem chip next year in an effort to reduce reliance on Qualcomm. According to Bloomberg, this first internally developed modem—produced by TSMC—will appear in lower-end iPhones and iPads before rolling out to Apple’s flagship models in subsequent generations.

Details:

🔧 Building Independence: Apple’s initial modem, code-named “Sinope,” will debut in the new iPhone SE next year. It’s a stepping stone: Apple has been working toward self-sufficiency in modem design since acquiring Intel’s smartphone modem business back in 2019.

📜 Generation Roadmap: By 2026, Apple hopes its second-generation modem, “Ganymede,” will match Qualcomm’s performance and power the iPhone 18 and upscale iPads by 2027. The third-gen “Prometheus,” targeted for release in 2027, aims to surpass Qualcomm with improved AI capabilities and next-gen satellite support.

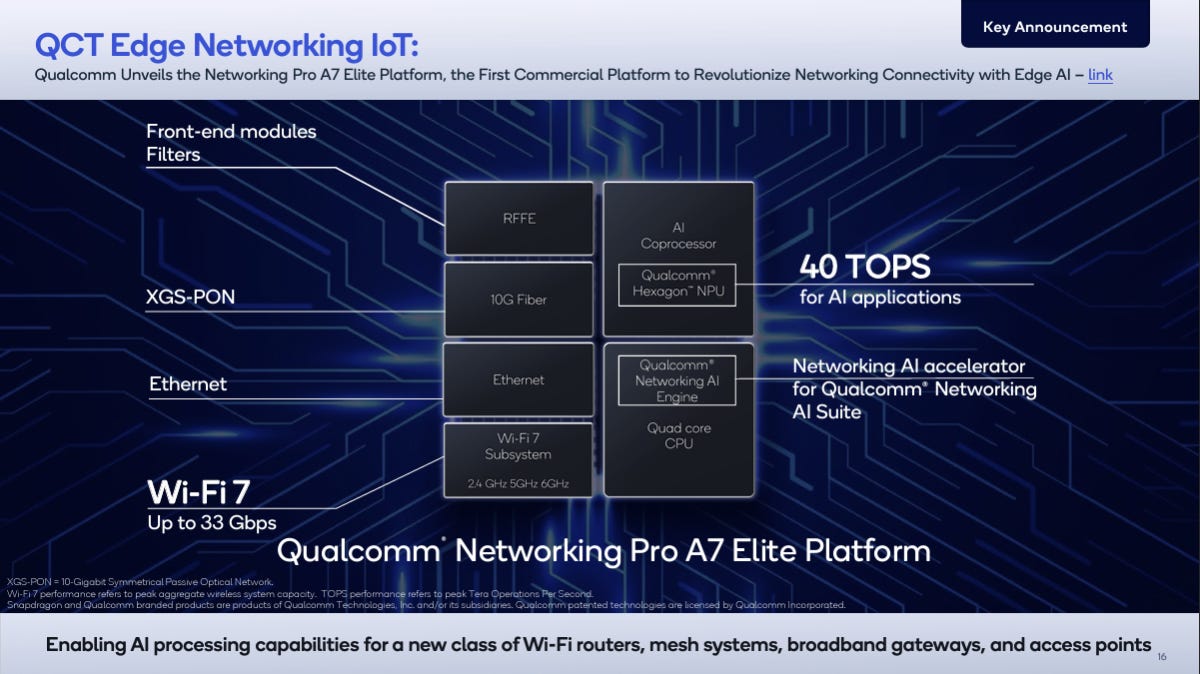

🌐 Strategic Shift: Qualcomm, a major supplier for Apple’s current modems, has effectively planned for zero Apple revenue by 2027 and beyond. To cushion this shift, Qualcomm is diversifying revenue streams across PCs, automotive, and industrial applications, targeting USD 22 billion in non-mobile revenue by 2029.

🗣 Management Perspective: While Apple hasn’t publicly commented on the new modems, executives like Senior VP of Hardware Technologies Johny Srouji have historically emphasized Apple’s desire to “control our own destiny” by owning key technologies. This strategic push is about engineering freedom and long-term cost control.

⚖️ Investor Watchpoints: Apple’s early in-house modems may lag behind Qualcomm’s in performance, at least initially. But Apple’s iterative approach and track record in chip design suggest they’ll learn from initial launches to refine future generations. Any performance bumps could impact consumer sentiment, but long term, in-house control could drive higher margins and product differentiation.

Why AI/Semiconductor Investors Should Care: Apple’s move exemplifies a major theme in the semiconductor space: vertical integration and reduced dependence on external vendors. For AI and semiconductor investors, it signals increasing competition in mobile connectivity and underscores Qualcomm’s need to diversify. If Apple’s strategy pays off, it could reshape smartphone supply chains and influence margin structures, making this a crucial development to watch.

Synopsys (SNPS)

😬 Synopsys Stumbles Post-Earnings: A Half-Year Hurdle?

What The Chip: Synopsys reported solid full-year fiscal 2024 results—15% revenue growth, record EPS, and robust margin expansion—but its stock took a hit after the company offered a tempered outlook for fiscal 2025’s first half. The company is balancing impressive long-term opportunities, like AI-driven chip design and multi-die architectures, against near-term uncertainties such as macroeconomic concerns, the timing of IP/hardware pull-downs, and restricted Chinese market conditions.

Details:

🚀 Record Year, Softer Start Ahead: Fiscal 2024 saw revenue surpass $6 billion with a 15% jump year-over-year, but 2025 guidance indicates a 45%-55% first-half/second-half revenue split—more back-loaded than usual—stemming from a fiscal calendar shift, fewer days in early quarters, and delayed hardware/IP deliveries.

🤝 Acquisition Anxiety: Synopsys expects to close its largest-ever acquisition, Ansys’ electronics unit, in the first half of 2025. Regulatory reviews are ongoing, and while customers reportedly support this “pro-competitive” deal, integrating such a major asset may temporarily slow near-term growth execution.

🔧 Tech Leadership Still Intact: The firm’s AI-driven EDA solutions, including the Synopsys.ai suite, have powered over 700 chip design tape-outs and reduced development times. Its advanced IP portfolio—covering PCIe 6, CXL, 40-gig UCIe, and other high-speed interfaces—saw strong demand from top hyperscalers and automotive players.

🌐 China Caution: Executives flagged the decelerating Chinese economy and expanded U.S. export restrictions as headwinds. With fewer new chip startups emerging and a shrinking customer pool, Synopsys remains pragmatic about its growth prospects in the region.

💸 Margins & Cash Flow: Management guided a 40% non-GAAP operating margin for 2025 and strong cash generation, even as it navigates big operational changes. “We remain focused on execution, excellence, and operating discipline,” said CFO Shelagh Glaser.

🗣 Management Insight: CEO Sassine Ghazi highlighted the company’s “transformational year” and “massive architectural revolution” toward multi-die and 3D IC designs, aiming to align Synopsys’ roadmap with customers’ future product cycles.

📉 Market Reaction: Shares slipped after the earnings call, suggesting investor concern over the uneven start to fiscal 2025 and the complexities of managing a large acquisition and geopolitical uncertainties.

Why AI/Semiconductor Investors Should Care: Synopsys’ stumble isn’t about technology—it’s about timing and transitions. The company’s long-term fundamentals remain strong: secular AI, multi-die architectures, and hyperscaler-driven silicon demand all point to sustainable growth. However, the near-term outlook implies heightened lumpiness and cautious guidance, challenging investors to differentiate between short-lived scheduling issues and the enduring strategic strengths that underlie Synopsys’ leadership in advanced chip design and IP.

Youtube Channel - Jose Najarro Stocks

Semiconductor Q3 Earnings Book — 50% OFF

X Account - @_Josenajarro

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.