Welcome, AI & Semiconductor Investors.

Broadcom’s bold $60-$90 billion AI push anchors it squarely at the heart of hyperscaler transformations, reshaping the data center landscape.

But as AMD’s data center ambitions accelerate and Intel’s co-CEOs vow product-first reforms, where does this leave the rest of the AI chip market? --- Let's find out...

What The Chip Happened?

⚡ Broadcom’s $60-$90 Billion AI Ambition: Riding the Hyperscale Wave

🔥 AMD Aims Higher in Data Center & AI: Turbocharged Chips Keep Momentum Going

💻 Intel’s Turnaround Play: Co-CEO Duo Bets on Products & Process to Reignite Growth

Read time: 8 minutes

Broadcom (NASDAQ:AVGO)

⚡ Broadcom’s $60-$90 Billion AI Ambition: Riding the Hyperscale Wave

What The Chip: Broadcom just wrapped up fiscal 2024 on a high note, largely driven by massive demand for its AI semiconductors and a surprisingly swift integration of VMware. In short, the company saw AI-related semiconductor revenue surge, placing it front and center in the multi-year data center AI build-out.

Details:

🚀 AI Takes Center Stage: Broadcom’s AI semiconductor revenue soared to $12.2 billion in fiscal 2024, up 220% year-over-year. CEO Hock Tan highlighted a potential $60-$90 billion AI serviceable addressable market (SAM) in 2027, driven by just three of its top hyperscale customers.

🍎 Steady Wireless & Recovery in Broadband: While non-AI segments have been mixed, wireless finished strong thanks to seasonal launches, and broadband, previously weak, is showing signs of improvement for fiscal 2025.

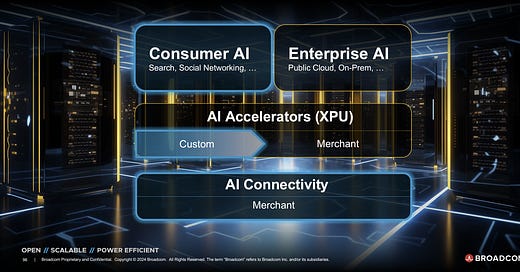

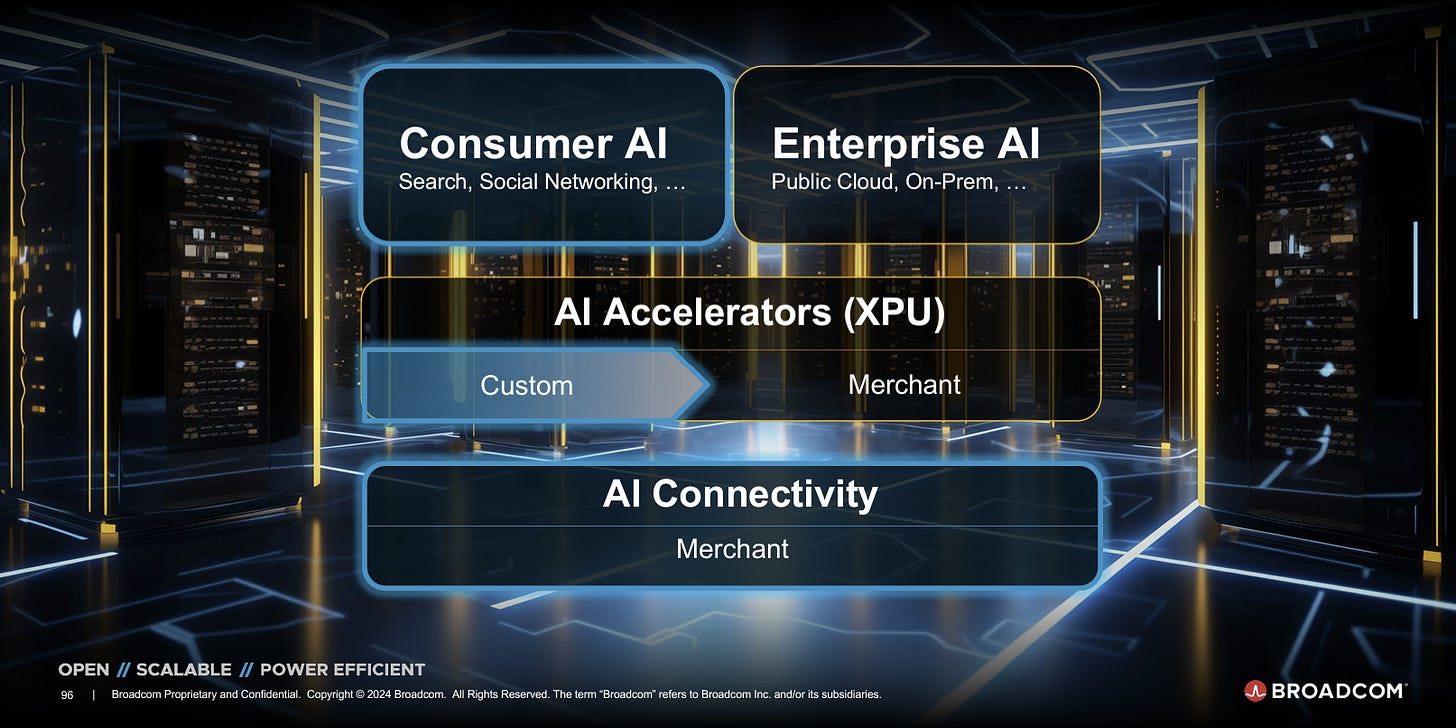

📡 Networking Advantage: 76% of Broadcom’s Q4 networking revenue came from AI-related connectivity, delivering essential Ethernet solutions to support clusters of one million+ AI accelerators. This helps lock Broadcom into the next-gen data center fabric plans of major cloud giants.

💻 VMware Integration Done & Dusted: The VMware acquisition integration is “largely complete,” boosting infrastructure software margins to 73% (excluding transition costs). Annualized booking value for VMware crossed $2.7 billion in Q4, exceeding expectations.

💬 Leadership Confidence: “We have line of sight,” said Hock Tan, underlining the company’s deep engagement with hyperscalers’ custom AI accelerators. “We’re very well positioned to achieve a leading market share,” he added, pointing to advanced silicon, packaging, and optical technology.

⚖ Balanced View: While the AI upside is massive, Broadcom warns of quarter-to-quarter variability and the complex, multi-year journeys of customers. Investors should keep an eye on the competition, changing architectures, and evolving product mix.

📈 Dividend & Financial Strength: The dividend got an 11% bump to $0.59 per share (split-adjusted), reflecting Broadcom’s confidence in stable cash flows. The company plans to use excess cash flow to reduce debt and is open to future acquisitions.

Why AI/Semiconductor Investors Should Care: Broadcom’s evolution highlights how crucial custom AI accelerators and advanced networking chips are for the next wave of cloud and AI infrastructure. Strong relationships with hyperscalers, large-scale TAM expansions, and rock-solid margins in software and semis put them in a prime position to capitalize on the multi-year AI mega-trend. Even as some segments remain cyclical, Broadcom’s big bets on AI semiconductors and infrastructure software integration could anchor long-term shareholder value.

Moore Semiconductor Investing

📗 Unlock Q3 Semiconductor Earnings --- 50% OFF

What The Chip: Get a front-row seat to the financials shaping the semiconductor industry. This continuously updated e-book by Jose Najarro distills the latest quarterly insights—from wafer production trends to AI chip breakthroughs—into a single comprehensive resource.

Details:

🔵 Dynamic Updates: Start with giants like TSMC and ASML, then expand to 30+ companies as their Q3 2024 earnings roll in. Already covering over 30 companies.

🔵 Huge Value for Half the Price: For a limited time, the e-book is discounted from $49.07 USD to $24.54 USD, offering a robust market guide at a significant value.

🔵 Expert Analysis: Curated by Jose Najarro (Master’s in Electrical Engineering, contributor at The Motley Fool), delivering reliable, accessible breakdowns.

🔵 Key Metrics & Trends: Follow critical financial indicators, market shifts, and executive comments shaping the sector’s trajectory.

🔵 Broad Coverage: From traditional chipmakers to cutting-edge AI semiconductor players, get the full picture as it emerges.

Why AI/Semiconductor Investors Should Care: This evolving earnings handbook gives you a strategic edge. Understanding quarterly earnings data is crucial for gauging industry health, discovering new growth leaders, and aligning your investment approach with emerging technological waves.

Disclaimer: For educational and informational purposes only. Not financial advice. Consult with a qualified professional before making any investment decisions.

Advanced Micro Devices (NASDAQ: AMD)

🔥 AMD Aims Higher in Data Center & AI: Turbocharged Chips Keep Momentum Going

What The Chip: At the Barclays Global Tech Conference on December 12, AMD’s CFO Jean Hu underscored the company’s surging position in server CPUs, rapid ascent in AI accelerators, and a broadening customer base. After achieving remarkable share gains and massive year-over-year growth in data center GPUs (from $0 to $5 billion in revenue this year), AMD is now focusing on pushing AI capabilities, next-gen products, and forging deeper customer ties across the data center and PC segments.

Details:

🚀 Server CPU Growth & Enterprise Push: AMD’s server CPU market share recently hit 34%. “When you look at the server side... we got a tremendous TCO performance,” said Hu. Although the company has excelled in cloud deployments, enterprise represents a largely untapped growth area. Expect AMD to lean into more direct CIO engagements to capture additional share.

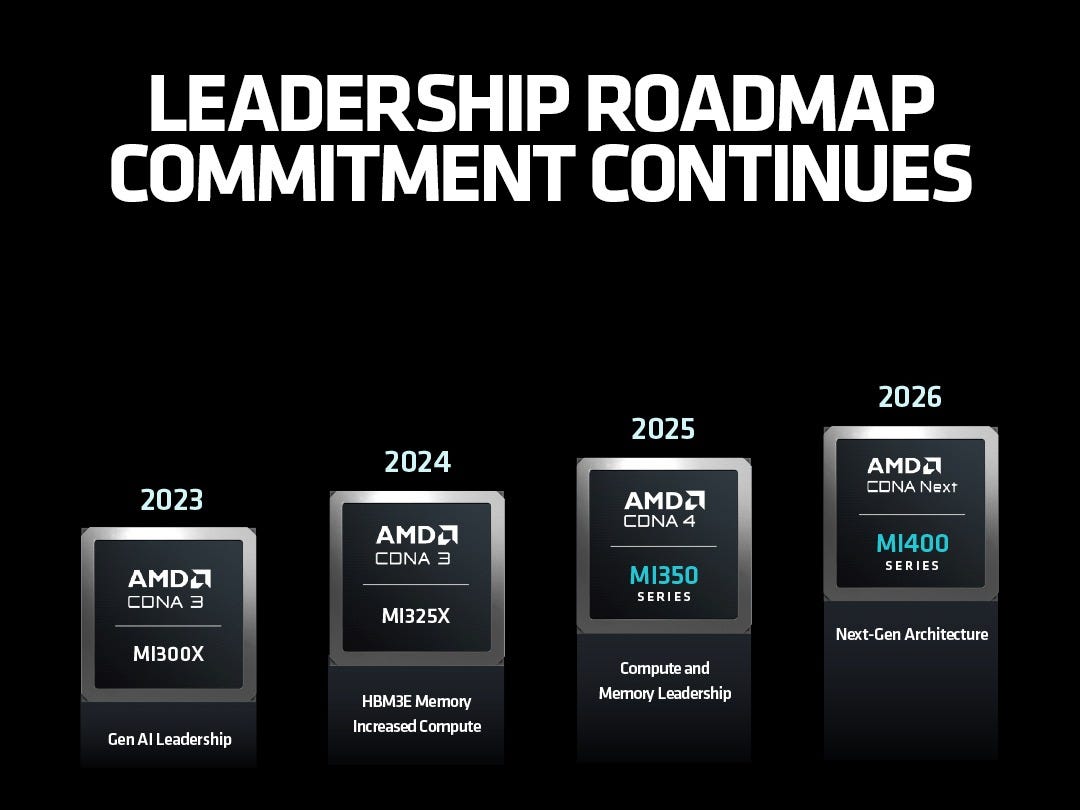

💡 AI Accelerators Skyrocket: Just a year ago, AMD’s MI300 GPU revenue was zero. Now, it’s on track for $5 billion in AI GPU sales for 2024, with Hu highlighting a richer product lineup in 2025, including MI325 and MI350. The company is also doubling down on software, systems (via the ZT Systems acquisition), and infrastructure to broaden its AI footprint.

🖥️ AI in the PC Market: With more AI-enabled PCs likely to hit the shelves by 2025, AMD expects AI PCs to command higher ASPs. “If you have AI accelerators and offer more features, you should get higher ASP,” noted Hu. This bodes well for the company’s CPU/GPU combo as Windows 10 end-of-life and new software experiences drive PC refresh cycles.

🔌 Embedded Stabilization & Xilinx Synergy: After a tough inventory correction cycle, embedded revenues appear to be stabilizing. Hu mentioned design wins remain robust, and the company expects “a gradual recovery” in 2025 as communication and industrial markets normalize.

📈 Strategic Investment & Margins: AMD sees gross margins improving from 50% in 2023 to around 53% in 2024. Although AI GPUs run below corporate average margins today, Hu emphasized that long-term, these products will become margin accretive. “Over time, we absolutely expect [data center GPUs] to be accretive to corporate average,” she said.

Why AI/Semiconductor Investors Should Care: AMD is balancing near-term wins with long-term strategy—advancing from CPU share gains to full-stack AI solutions. The rapid ramp in data center GPUs, deeper software investments, and expanding solutions for enterprise and PCs position AMD as a strong contender in the multi-year AI and HPC build-out. For investors, AMD’s approach suggests sustainable margin expansion and diversified growth drivers, even as it squares off against entrenched rivals and an evolving competitive landscape.

Intel (NASDAQ:INTC)

💻 Intel’s Turnaround Play: Co-CEO Duo Bets on Products & Process to Reignite Growth

What The Chip: Intel’s interim co-CEOs, Michelle Holthaus (also newly appointed permanent CEO of Products) and David Zinsner (CFO), emphasized a product-first strategy amid leadership changes and ongoing challenges in the data center and AI spaces. With a renewed focus on delivering innovative chips—whether manufactured internally or externally—Intel aims to rebuild trust, stabilize market share, and ramp its foundry business.

Details:

🚀 Customer-First and Product-Led: Michelle Holthaus, previously head of sales, will drive product strategy as CEO of Products. The goal: deliver on schedules and performance promises. “We weren’t making enough product investments,” Holthaus admitted, and the company plans to correct course and regain share, especially in the data center.

🏭 Pragmatic Manufacturing Choices: While Intel Foundry remains key, the company won’t hesitate to tap external partners like TSMC for certain CPUs or GPUs if it improves time-to-market and competitiveness. “If that needs to be done, I’ll make that decision,” said Holthaus.

💡 AI PCs & x86 Future: Despite competition from Arm-based PCs, Intel believes that AI PCs—equipped with neural processing units (NPUs)—will drive refresh cycles, push ASPs higher, and hit volume in 2025. Intel acknowledges competition, but sees decades-long customer relationships as a competitive edge.

🗄️ Data Center Reset: Intel admits it fell short in data center CPUs and acknowledges a limited opportunity for near-term TAM growth. Stabilizing share in 2025 with upcoming products (e.g., Diamond Rapids) is key. On AI accelerators, Intel will take a “learn and iterate” approach, leveraging Gaudi as a stepping stone to future GPUs like Falcon Shores, but not afraid to pivot as needed.

📉 Cost Control & Profitability Goals: CFO Zinsner signaled ongoing operational and cost-efficiency efforts. Intel will continuously trim spending, seek reuse of equipment, and consider strategic moves for underperforming assets like Altera. The company is intent on expanding gross margins and operating margins, with net CapEx offset by government incentives and tax credits.

Why AI/Semiconductor Investors Should Care: The new co-CEO structure underscores a back-to-basics approach: products that customers want, delivered reliably, even if it means relying on external foundries temporarily. With a renewed emphasis on faster iteration and pragmatic investment, Intel aims to restore credibility, stabilize data center share, and seize the emerging AI PC opportunity. As Intel marches toward 18A process leadership and grows its foundry business, investors should watch for signs of improved execution, stronger product cadence, and sustainable profitability.

Youtube Channel - Jose Najarro Stocks

Semiconductor Q3 Earnings Book — 50% OFF

X Account - @_Josenajarro

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.